Discussions about how to Improve Social Financing are recurrent – and that’s the way it should be

There is no event, publication or discussion about social financing that doesn’t point to the mismatch between the provision of capital supposedly designated to create impact and the financing needs of social enterprises. Innovative forms of financing have been designed in the last years, including patient capital, crowdfunding or social impact bonds, and the amount of capital theoretically deployed as impact investment continues to increase. As statistics from the Global Impact Investment Network (GIIN) show, overall, more than USD $12 billion in impact investments have been deployed in emerging markets in 2019 – compared to approximately USD $7 billion in 2015.[1]

However, these figures refer to a wide understanding of impact investment and include investments made with market-rate financial return expectations included. If we only look at deals made with below-market-rate expectations, the investment sum shrinks to around USD $280 million.[2] This resonates with reports from social entrepreneurs and their representatives who state that access to appropriate funding remains a considerable challenge for the vast majority of social enterprises around the world.

While many actors in this space are feeling tired of these discussions, we insist that these discussions are much needed and advantageous. Even more, they are mandatory in order to tackle the substantial gaps that persist in the financial infrastructure of the impact sector.

Some epNetwork members learning the language of finance at an epWorkshop in 2019.

Some epNetwork members learning the language of finance at an epWorkshop in 2019.

This is one of the key findings of Siemens Stiftung’s new report ‘How Digital Solutions May Enhance Social Financing’, for which Studio Nima collaborated as editing partner. As the results of multi-stakeholder discussions and working sessions that we have conducted over the last months have shown, there are digital solutions that, indeed, have the potential to enhance the social financing sector. Effective solutions should address certain pain points such as improving matchmaking between suitable funders and social finance seekers or by making the due diligence process more efficient and, thus, more affordable. Such measures can significantly contribute to making the whole sector more impactful.

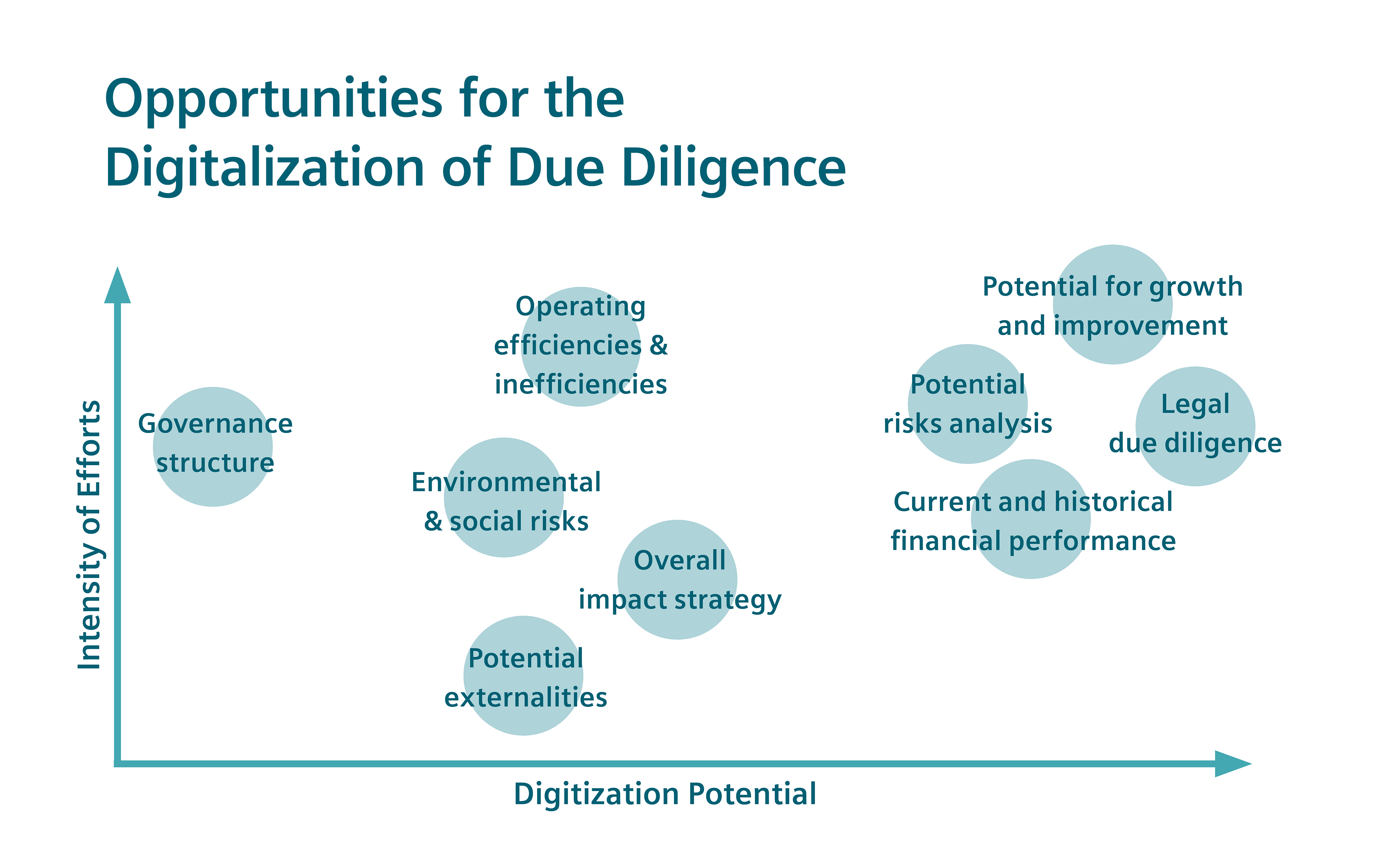

The opportunities for digitalization of due diligence processes can be looked at by intensity of efforts and digital potential.

The opportunities for digitalization of due diligence processes can be looked at by intensity of efforts and digital potential.

However, what all discussions have shown: it won’t be a one-size-fits-all solution. The heterogeneity of the impact sector, the differences in culture and expectations, as well as the amount of possible misunderstandings are so big that any solution that tries to integrate everything is likely to fail. Smaller solutions are needed; ones that tackle bits and pieces of the financial infrastructure for social enterprises while, at the same time, ensuring interoperability with other existing solutions that are commonly used in the sector. In the field of matchmaking, this could include solutions that help pool players around similar missions, provide reputation tracking and indicators about responsiveness. Solutions could also focus on setting standards regarding the use of existing software, e.g. through partnerships.

In the field of due diligence, digital solutions could focus on specific parts of this process that are usually time- and resource-intense, such as financial forecasts, historical accounts, an analysis of the business strategy & market performance, or a focus on legal and regulatory compliance.

Digital solutions could focus on the validation of data accuracy and coherence. Machine learning algorithms could transform diverse input formats of documents into standardized outputs for more homogeneity and comparability in due diligence or take over the validation of assumptions made in business plans based on market research.

Furthermore, these smaller digital solutions need to be accompanied by strong offline support for social entrepreneurs to learn how to become more attractive for investors and for investors to learn how to adapt their products and services to the realities of social entrepreneurs. This is even more relevant when investors with Western backgrounds are seeking investment deals in the Global South and vice versa. Capable mediators that speak the jargon of experienced financing professionals and have the necessary know-how about local markets are essential in order to translate their knowledge into workable instructions for social entrepreneurs and investors.

If social financing – and by this we mean any type of financing that explicitly seeks to create social or environmental impact – is to significantly contribute to solving significant global challenges and achieve the Sustainable Development Goals, it simply needs much more impact-oriented funding that truly meets the needs of organizations that deliver on social missions. This requires entering into a blunt discussion, showing sincere interest in each other’s position and developing solutions that further deviate from long-established processes of the commercial and philanthropic financing sector. Particularly in a world that is increasingly relying on digital workflows – today more than ever – we are deeply convinced that new technologies can be of considerable help and should be supported by players who ideally prioritize impact over profitability of such solutions.

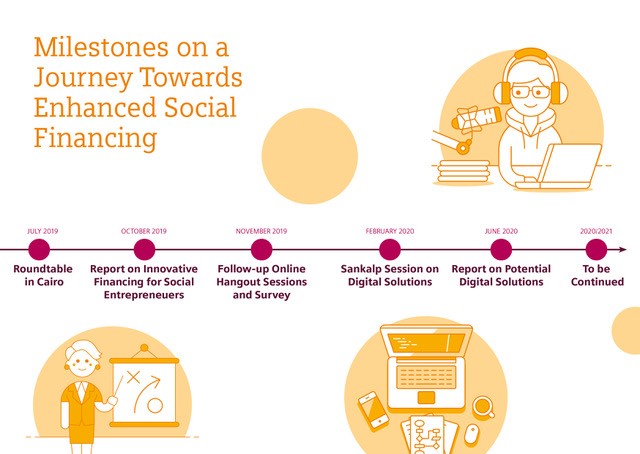

Some important milestones on our journey towards a sustainable social impact environment for both SocEnts and impact investors.

Some important milestones on our journey towards a sustainable social impact environment for both SocEnts and impact investors.

We, thus, encourage all involved parties, particularly funders and finance intermediaries, to expose themselves to those honest – and possibly recurrent – discussions, and agree on common standards. With this, parts of the matchmaking and due diligence process may effectively be digitalized step-by-step. Convening partners, such as Siemens Stiftung, whose mission lies in supporting impact organizations, are ideal players for facilitating this process and making sure it accounts for the voices of social entrepreneurs.

[1] https://thegiin.org/research/publication/impinv-survey-2020#charts

[2] https://thegiin.org/research/publication/impinv-survey-2020#charts